39 definition of coupon rate

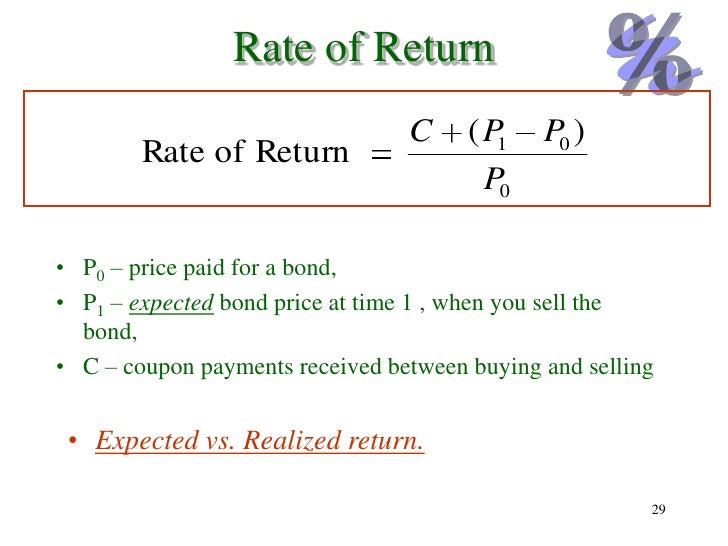

DV01 - Definition, Calculation and Quiz | Business Terms Consider a $1,000.00 bond paying an annual coupon of 10.00% maturing in 5 years time trading at par, i.e., with a yield-to-maturity (YTM) of 10%. Since the current YTM is 10%, which matches the coupon rate, the price of the bond will equal the present value of its cash flows at $1,000.00. What is Coupon Rate? Definition of Coupon Rate, Coupon ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

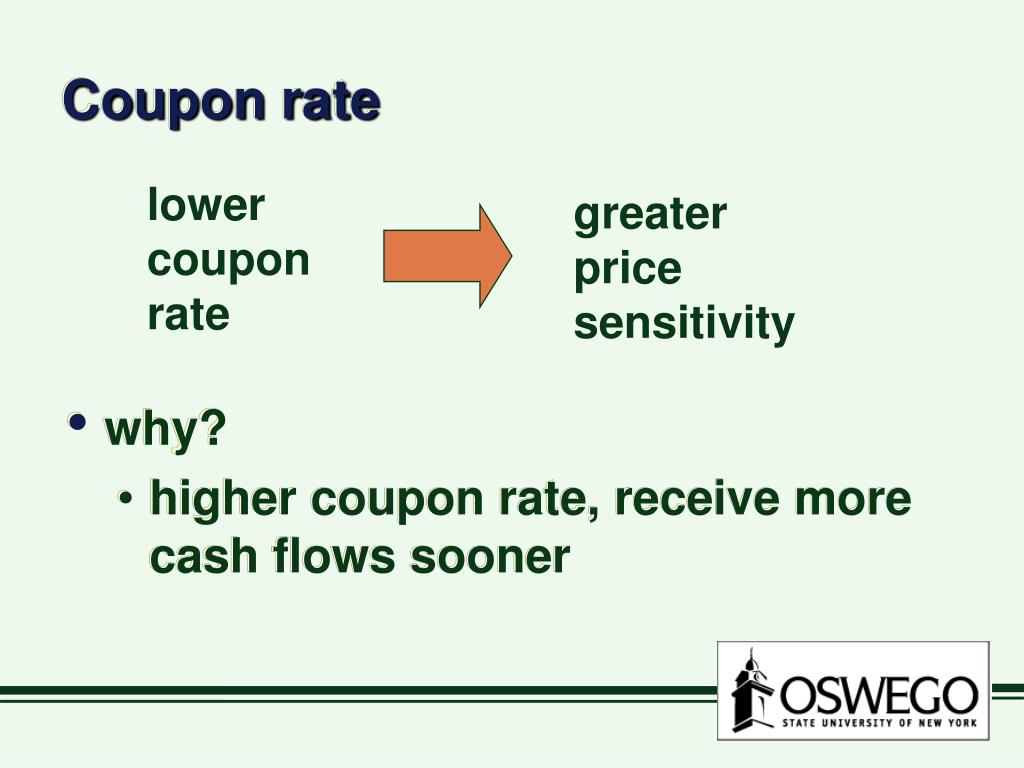

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. Government and non-government entities issue bonds to raise money to finance their operations. When a person buys a bond, the bond issuer

Definition of coupon rate

Coupon Rate of a Bond (Formula, Definition) | Calculate ... Coupon Rate is referred to the stated rate of interest on fixed income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more securities such as bonds. Coupon rate definition - AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

Definition of coupon rate. Solved Which one of the following is the correct ... 100% (2 ratings) Answer : Correct Option is …. View the full answer. Transcribed image text: Which one of the following is the correct definition of a coupon rate? A) semi-annual interest payment/par value B) annual interest/par value C) annual interest/market value D) semi-annual coupon/bond price E) annual coupon/bond price. Coupon Rate Definition The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... nominal coupon rate (Financial definition) - iotafinance.com The nominal coupon rate is the rate of interest that is due to the holder of a bond on each coupon date. The coupon rate is expressed as a percentage of the bond's nominal. The coupon rate is stated in the bond's prospectus and is one of its main characteristics. It is expressed as a percentage of the bond's face value. Bond Coupon Rate Definition | Law Insider Define Bond Coupon Rate. means the rate of interest accruing on the Bonds based on the Interest Rate Mode then in effect; provided that, following an Event of Default hereunder, the Bond Coupon Rate shall equal the Default Rate. In addition, the Bond Coupon Rate shall include any interest payable under the Note in excess of interest at the foregoing rate.

› terms › sSpot Rate Definition Feb 17, 2021 · Commodity spot rates are based on supply and demand for these items, while bond spot rates are based on the zero-coupon rate. A number of sources, including Bloomberg, Morningstar, and ... Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms... Coupon rate financial definition of Coupon rate The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons. Coupon Rate: Definition, Formula & Calculation - Video ... The coupon rate is the annualized interest also referred to as the coupon, divided by the initial loan amount. The initial loan amount is the par value. In the example given, the coupon rate is the...

Coupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence. › nominal-interest-rateNominal Interest Rate (Definition, Formula) | Calculation ... For example, Car loans are available at 10% of the interest rate. This face an interest rate of 10% is the nominal rate. It does not take fees or other charges in an account. Bond available at 8% is a coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the ... Coupon Definitions | What does coupon mean? | Best 12 ... A periodic interest payment due to the holder of a bond. noun 0 0 The interest rate of a bond that pays a coupon. noun 0 0 One of a set of small certificates that may be detached from a bond certificate and redeemed for interest payments. noun 0 0 The interest payment that must be made on a note or bond until it matures. › bonds-payable-accountingBonds Payable on Balance Sheet (Definition, Examples) Coupon rate – The coupon rate, which is generally fixed, determines the periodic coupon or interest payments. It is expressed as a percentage of the bond’s face value. It also represents the interest cost of the bond to the issuer. The coupon rate is 2.375% in the case of a $1 billion offer.

What is Coupon Rate | What is Coupon Payment | Coupon Interest of a Bond By Knowledge Topper ...

Coupon rate Definition | Nasdaq Coupon rate In bonds , notes , or other fixed income securities , the stated percentage rate of interest , usually paid twice a year. Most Popular Terms:

coupon rate: Meaning and Definition of | Infoplease Infoplease knows the value of having sources you can trust. Infoplease is a reference and learning site, combining the contents of an encyclopedia, a dictionary, an atlas and several almanacs loaded with facts.

What Is the Coupon Rate of a Bond? A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

Floating Coupon Rate Definition | Law Insider Coupon Rate has the meaning set forth in Section 2.8. CB Floating Rate means the Prime Rate; provided that the CB Floating Rate shall never be less than the Adjusted One Month LIBOR Rate on such day (or if such day is not a Business Day, the immediately preceding Business Day).

What Are Corrosion Coupons? - Chardon Labs Corrosion coupons are pre-weighed and measured metal strips which are mounted in a special pipe system called a coupon rack . They are used to estimate the rate of metal corrosion by comparing the initial weight with the weight following 60, 90 or 120 days of exposure to the water in the system.

Coupon interest rate financial definition of coupon ... coupon interest rate the INTEREST RATE payable on the face value of a BOND. For example, a £100 bond with a 5% coupon rate of interest would generate a nominal return of £5 per year. See EFFECTIVE INTEREST RATE. Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005 Want to thank TFD for its existence?

Coupon Rate - Meaning, Calculation and Importance Coupon Rate = 100 / 500 * 100 = 20%. Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds. Bonds pay interest to their holders. The coupon rate is the amount of interest the bondholder receives.

support.google.com › google-ads › answerClickthrough rate (CTR): Definition - Google Ads Help Clickthrough rate (CTR): Definition A ratio showing how often people who see your ad or free product listing end up clicking it. Clickthrough rate (CTR) can be used to gauge how well your keywords and ads, and free listings, are performing.

How do you calculate CPN finance? - FindAnyAnswer.com Definition of 'Coupon Rate' Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. The bond issuer pays the interest annually until maturity, and after that returns the principal amount (or face value) also.

What Is a Certificate of Deposit Coupon? | Pocketsense A coupon is the stated rate of interest on the certificate of deposit. The term comes from bonds that have coupons that must be torn off the original bond and redeemed to be paid the interest due. The interest rate specified by the coupon is paid at set intervals.

› terms › aAt Par Definition Mar 19, 2022 · A coupon rate is the yield paid by a fixed income security, which is the annual coupon payments divided by the bond's face or par value. more Deep-Discount Bond Definition

What is coupon rate | Definition and Meaning | Capital.com A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. The coupon payment on a bond is the interest payment received by the holder of the bond until the bond matures. Coupon rate formula The coupon rate calculations formula is simple.

Coupon rate Definition & Meaning | Dictionary.com coupon rate 📓 High School Level noun the interest rate fixed on a coupon bond or other debt instrument. QUIZ QUIZ YOURSELF ON HAS VS. HAVE! Do you have the grammar chops to know when to use "have" or "has"? Let's find out with this quiz! Question 1 of 7 My grandmother ________ a wall full of antique cuckoo clocks. has have

Learn About Coupon Interest Rates | Chegg.com The coupon interest rate indicates the annual interest rate paid by the issuer of the bond, taking into consideration its face value. The coupon interest rate is visualized in percentage form. The coupon rate is calculated by dividing annual coupon payments with the face value of the bond.

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ...

Post a Comment for "39 definition of coupon rate"